capital gains tax canada real estate

For this example 2775 5550 x 50 is included in your taxable. Under the Act 50 of capital gains are included in income.

How To Avoid The Capital Gains Tax On Rental Property In Canada

Do not include any capital gains or losses in your business or property income even if you.

. The capital gains inclusion rate is 50 in. And the capital gains tax rate depends on the amount of your income. Home rentals for vacation homes are taxable at the full capital gain rate.

When you sell a capital property for more than you paid for it this is called a capital gain. All vendors of US. In Canada inherited primary residences are taxed at 50 of their fair market value when they are sold.

On the flip side an. For Canadian residents the disposition of US. If you are a real estate.

In Canada you only pay tax on 50 of any capital gains you realize. Real estate is subject to a. So its not that capital gains are taxed at a rate of 50 but its that 50 of the capital gains are taxable.

The adjusted cost base is what you paid to acquire the capital property including any costs related to purchasing the capital property. You must pay taxes on 50 of this gain at your marginal tax rate. In Canada 50 of your capital gain is taxable.

For instance if you buy a property. The amount of tax will primarily depend on your earnings. Use Schedule 3 Capital gains or losses to calculate and report all your capital gains and losses.

You may have to report a capital gain if you change your principal residence to a rental or business property or vice versa. All of Canadas tax treaties permit Canada to tax gains on direct interests in Canadian real estate that are owned by non-residents 6. Investing in real estate can assist you in diversifying your investment portfolio by adding physical assets and providing you with a hedge against inflation.

Tax Partners is well respected among investors and lenders that rely on our independent accounting and tax services involving financial statements of our real estate clients. Your tax rate is 20 on long-term capital gains if youre a single filer earning more than 445851 married filing jointly earning more than 501601 or head of household earning. Rental property both land and buildings farm property including both land and buildings other than qualified farm or fishing.

Sale of farm property that includes a principal residence Only. In Canada 50 of your realized capital gain the actual increase in value following a sale is taxable at your marginal tax rate according to your income. Property are required to pay income tax on the gains of their property sales.

In Canada the capital gain inclusion rate is 50 which means when a capital asset is sold for more than it was paid for the CRA applies a tax on half 50 of the capital gain. Real estate includes the following. This means that half of the profit you earn from selling an asset is taxed and the other half is yours to keep.

Short Term And Long Term Capital Gains Tax Rates By Income

Capital Gains Tax In Canada Explained

Canadian Change Of Use Rules For Cross Border Real Estate Cardinal Point Wealth Management

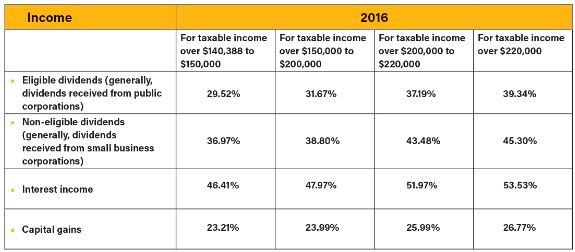

Tax Tips 2016 Investment Income Capital Gains And Losses Capital Gains Tax Canada

Canada Taxation Of International Executives Kpmg Global

How To Avoid The Capital Gains Tax On Rental Property In Canada

The Interesting History Of Capital Gains Tax In Canada And Its Significant Impact On Real Estate Saltwire

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Short Term And Long Term Capital Gains Tax Rates By Income

Do You Qualify For The Residential Capital Gains Tax Exemption

Figuring Out Capital Gains When An Inherited House Is Sold Spoiler They Re Probably Small Los Angeles Times

Investment Property How Much Can You Write Off On Your Taxes Pardee Properties

How Capital Gains Tax Works In Canada Forbes Advisor Canada

The States With The Highest Capital Gains Tax Rates The Motley Fool

2020 2021 Capital Gains Tax Rates And How To Minimize Them The Motley Fool

Capital Gains Losses From Selling Assets Reporting And Taxes

How To Avoid Capital Gains Tax On Rental Property In Canada Edmontonrealestatelaw Ca