colorado paycheck calculator hourly

The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. How to Calculate Gross Profit Margin.

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Nanny tax and payroll.

. Youll need to know the difference between the annual salary the employee was paid and the salary that should have been. Overview of Colorado Taxes Colorado is home to Rocky Mountain National Park upscale ski resorts and a flat income tax rate of 45. 00 hours 725 000 tips.

Simply enter the number of your working hours each week and the amount made during the working period you selected and you will see your income in hourly weekly monthly quarterly and annually. It can also be used to help fill steps 3 and 4 of a W-4 form. You can use this calculator to determine your pre-tax earnings at an hourly wage-earning job in Florida.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Our calculator will generate your FICA Withholding and all deductions on your Texas stub preview. In addition you should be able to verify the number of payroll days in the year this is the number of days workedmaking sure to deduct.

Log in 888 273-3356. Calculating retroactive pay for salaried staff is a little more difficult than calculating for hourly workers. Payroll and HR Resources.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. The hourly to salary calculator is will convert your hourly wage to annually salary and vice versa. Tax Year for Federal W-4 Information.

Switch to Colorado salary calculator. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Use Before 2020 if you are not sure.

1-855-216-7740 option 3 Hours. We have designed this free tool to let you compare your paycheck withholding between 2 dates. Other Income not from jobs Other Deduction.

Social Security and Medicare. Need help calculating paychecks. What does eSmart Paychecks FREE Payroll Calculator do.

Helpful Paycheck Calculator Info. Similar to the white-collar GS Payscale an employees pay under the FWS is determined by their pay grade determined by their job title and seniority and pay step determined by how long they have worked in that position. Check out our blog for.

Contact your CU benefits professionals. Residents who live in Aurora Denver. This Colorado hourly paycheck calculator is perfect for those who are paid on an hourly basis.

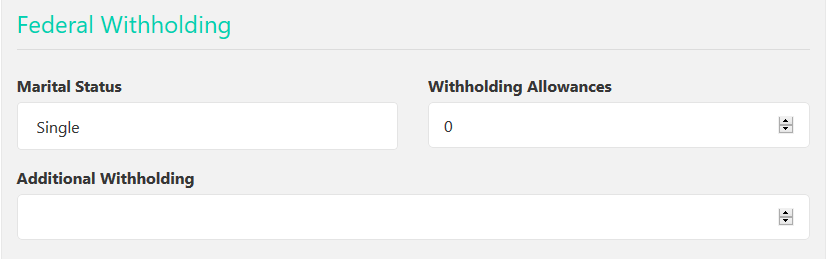

Lets be honest - sometimes the best gross profit margin calculator is the one that is easy to use and doesnt require us to even know what the. Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs. Instead you fill out Steps 2 3 and 4 Help for Sections 2 -- Extra Withholding because of Multiple Jobs If your household has only one job then just click Exit.

For example in the tax year 2020 Social Security tax is 62 for employee and 145 for Medicare tax. Make payroll and filing taxes a fast and efficient process. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

303-860-4200 option 3 Toll-free. Your paycheck might have a very different impact on your budget if youre forced to work around the clock to earn it. Exemption from Withholding.

There is in depth information on how to estimate salary earnings per each period below the form. Of course our free online gross profit margin calculator does the calculations instantly for you so all you have to do is just enter in the total sales and the COGS above and press the calculate button. Check if you have multiple jobs.

Download a PDF Report. For Partners 888 273-3356. Working 40-hour weeks for 120000 per year is remarkably different from working 90-hour weeks for 120000 per year.

Filing Status Children under Age 17 qualify for child tax credit Other Dependents. Use this hourly paycheck calculator to determine take-home pay for hourly employees. The calculation is based on the 2022 tax brackets and the new W-4 which in 2020 has had its first major change.

Calculate your Colorado net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Colorado paycheck calculator. Welcome to the Florida Wage Calculator. Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social security and medicare.

Use ADPs Colorado Paycheck Calculator to calculate net take home pay for either hourly or salary employment. Learn how much should you be paid in 2022. Also known as a dependent care account this employer-provided benefit allows you to set aside a portion of your paycheck tax-free to pay for medical and dependents care expenses.

Computes federal and state tax withholding for paychecks. But there are very good reasons for figuring out how much you earn on an hourly basis. However if you wish to have a copy of your timesheet employee attendance record it.

Colorado has a straightforward flat income tax rate of 455 as of 2021. If you have a household with two jobs and both pay about the same. Payroll taxes change all of the time.

This calculator is intended for use by US. Gross Pay Method Gross Pay YTD. The Office of Personnel Management with the help of local labor unions establishes hourly FWS pay tables for every major Government facility in the United States.

2022 W-4 Help for Sections 2 3 and 4 Latest W-4 has a filing status line but no allowance line. Create pay check stubs for your Texas employees or. This salary paycheck calculator will help you figure out take-home pay for salaried employees.

This calculator can determine overtime wages as well as calculate the total earnings for tipped employees. Switch to Colorado hourly calculator. Flexible hourly monthly or annual pay rates bonus or other earning items.

00 hours 725 000 overtime. Add Rate Remove Rate. Choose Tax Year and State.

Got a question or need some advice. EXPORTING THE WORK HOURS CALCULATOR DATA. If youre finished you can send them to your employees and you can make as many changes as you like.

A 2020 or later W4 is required for all new employees. Monday to Friday Email. Overview of Utah Taxes Utah has a very simple income tax system with just a single flat rate.

Just enter in the required info below such as wage and W-4 information and our tool will perform the necessary calculations. Hourly Wage Calculator This hourly wage calculator helps you find out your annual monthly daily or hourly paycheck having regard to how much you are working per day week and pay rate. W4 Employee Withholding Certificate The IRS has changed the withholding rules effective January 2020.

Free Federal and State Paycheck Withholding Calculator. Tax breaks for qualified dependents are available to all tax payers regardless of their income so long as both spouses are either employed or full-time students. If all you need is a hard copy of your free work hours calculator report just use the Print This button and youre ready to send it off to your accounting department or store it as a permanent record.

Texas Paystub Maker choose customizable templates.

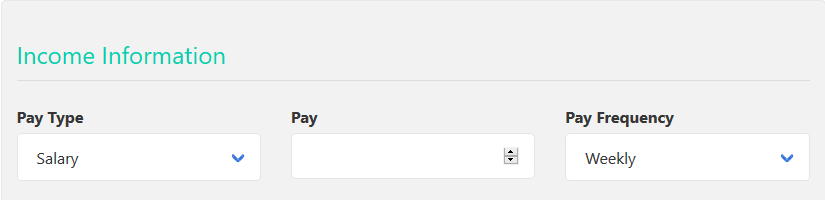

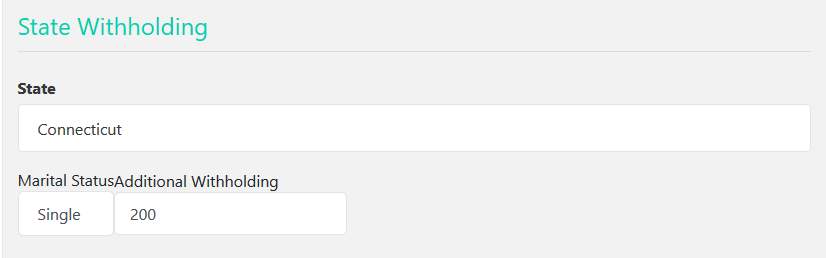

Free Paycheck Calculator Hourly Salary Usa Dremployee

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Individual Income Tax Colorado General Assembly

Free Paycheck Calculator Hourly Salary Usa Dremployee

Free Hourly Paycheck Calculator

Free Paycheck Calculator Hourly Salary Usa Dremployee

Free Paycheck Calculator Hourly Salary Usa Dremployee

Free Paycheck Calculator Hourly Salary Usa Dremployee

Hourly Paycheck Calculator Nevada State Bank

Salary Paycheck Calculator Calculate Net Income Adp

Colorado Paycheck Calculator Smartasset

Colorado Paycheck Calculator Smartasset

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Colorado Paycheck Calculator Updated On Tax Year 2022

Paycheck Calculator Take Home Pay Calculator

Free Paycheck Calculator Hourly Salary Usa Dremployee

Paycheck Calculator Take Home Pay Calculator